Some Known Questions About Whole Farm Revenue Protection.

Everything about Whole Farm Revenue Protection

Table of ContentsA Biased View of Whole Farm Revenue ProtectionSome Ideas on Whole Farm Revenue Protection You Should KnowWhole Farm Revenue Protection Fundamentals ExplainedThe 45-Second Trick For Whole Farm Revenue ProtectionHow Whole Farm Revenue Protection can Save You Time, Stress, and Money.Some Known Incorrect Statements About Whole Farm Revenue Protection How Whole Farm Revenue Protection can Save You Time, Stress, and Money.

Ranch and cattle ranch residential or commercial property insurance covers the properties of your farm and also ranch, such as livestock, equipment, structures, setups, and also others. Think about this as business residential property insurance coverage that's only underwritten for companies in farming. These are the common protections you can obtain from farm as well as cattle ranch home insurance policy. The equipment, barn, equipment, tools, animals, supplies, and equipment sheds are important possessions.Your ranch as well as cattle ranch makes use of flatbed trailers, confined trailers, or energy trailers to carry items and also tools. Industrial automobile insurance policy will certainly cover the trailer yet just if it's connected to the insured tractor or vehicle. If something occurs to the trailer while it's not connected, then you're left on your own.

Employees' compensation insurance policy provides the funds a staff member can use to buy medicines for a work-related injury or illness, as prescribed by the physician. Employees' compensation insurance covers rehabilitation.

4 Simple Techniques For Whole Farm Revenue Protection

You can insure on your own with workers' compensation insurance. While acquiring the policy, carriers will certainly give you the freedom to include or omit on your own as an insured.

Some Ideas on Whole Farm Revenue Protection You Need To Know

Lots of ranch insurance coverage carriers will additionally use to compose a farmer's auto insurance coverage. In some circumstances, a ranch insurance provider will just use particular kinds of auto insurance or only guarantee the vehicle threats that have procedures within a particular range or scale.

Regardless of what carrier is writing the farmer's auto insurance coverage, hefty as well as extra-heavy trucks will need to be placed on a industrial car policy. Trucks titled to a business ranch entity, such as an LLC or INC, will need to be positioned on a business policy no matter the insurance service provider.

If a farmer has a semi that is made use of for transporting their own ranch products, they may have the ability to include this on the very same industrial auto plan that guarantees their commercially-owned pickup. However, if the semi is used in the off-season to carry the products of others, many common farm and business automobile insurance coverage carriers will certainly not have an "hunger" for this kind of threat.

The 9-Minute Rule for Whole Farm Revenue Protection

A trucking plan is still a commercial car policy. The providers that browse this site use protection for operations with lorries utilized to carry products for 3rd events are normally specialized in this type of insurance. These kinds of operations develop higher risks for insurers, bigger claim quantities, and also a higher intensity of insurance claims.

A seasoned independent representative can aid you decipher the sort of plan with which your commercial vehicle should be guaranteed and also clarify the nuanced implications as well as insurance coverage ramifications of having numerous automobile policies with different insurance policy service providers. Some trucks that are utilized on the farm are guaranteed on individual car policies.

Business automobiles that are not eligible for a personal vehicle plan, however are used specifically in the farming procedures provide a decreased risk to insurance firms than their industrial use equivalents. Some providers opt to guarantee them on a farm auto plan, which will have a little different underwriting criteria and also score frameworks than a routine commercial vehicle policy.

Fascination About Whole Farm Revenue Protection

Several farmers relegate older or restricted usage cars to this sort of enrollment since it is an affordable method to maintain a vehicle being used without every one of the additional expenses commonly associated with cars. The Department of Transportation in the state of Pennsylvania categorizes numerous various sorts of unlicensed farm vehicles Kind A, B, C, and D.

Time of day of usage, miles this hyperlink from the house ranch, and other constraints put on these types of lorries. So, it's not a good idea to entrust your "day-to-day chauffeur" as an unlicensed ranch vehicle. As you can see, there are several types of ranch vehicle insurance coverage readily available to farmers.

7 Simple Techniques For Whole Farm Revenue Protection

It is necessary to review your vehicles and their usage freely with your representative when they are structuring your insurance profile. This sort of detailed, conversational method to the insurance buying procedure will certainly help to guarantee that all protection gaps are closed as well as you are obtaining the biggest worth from your policies.

Please note: Info and insurance claims presented in this material are meant for helpful, illustratory functions and must not be considered legitimately binding.

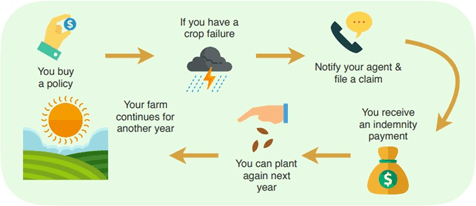

Crop hailstorm coverage is offered by private insurance firms and also regulated by the state insurance divisions. There is a federal program providing a selection of multi-peril plant insurance items.

Rumored Buzz on Whole Farm Revenue Protection

Unlike various other kinds of insurance coverage, crop insurance is reliant on well-known days that use to all plans. These are the crucial days farmers ought to expect to meet: All crop insurance policy applications for the designated county and crop navigate to this site are due by this date.